Business

Missouri House again votes to cut corporate income taxes

The Missouri House sent a bill repealing the corporate income tax to the Senate on a party-line vote Wednesday, with Republicans saying it will boost economic growth and Democrats calling it a business giveaway.The bill sponsored by state Rep. Travis Smith of Dora would cut the tax rate, currently 4%, to 3% on Jan. 1 and make another one percentage point cut each year until the tax is eliminated in 2028.“When you reduce the corporate income tax you are helping workers more than anything else because the corporation is not going to be paying those taxes,” Smith said. “They’re putting it back in improving their facilities and paying wages.”The corporate income tax is paid by larger companies with many stockholders. A fiscal note for the bill estimates it would reduce state revenues by at least $884 million when fully implemented. The state collected $13.2 billion in general revenue in the fiscal year that ended June 30.The bill passed on a 100-50 vote with Republicans voting for it and Democrats opposed.“We are one of the lowest corporate income tax states in the nation,” said state Rep. Joe Adams, a University City Democrat.Legally, Adams noted, corporations are people with many of the same rights as humans.“As people they should pay part of the freight for the operation of the government of this state,” Adams said.Missouri’s corporate income tax for decades was 5%. In 1993, in a bill that increased revenue to pay for education needs, the tax was boosted to 6.25%. The rate was cut to 4% in 2018.This is the second year in a row that the House has voted to cut the corporate tax. Last year, the House voted to cut the rate in half but the Senate did not go along. A similar bill is awaiting debate on the Senate.Lawmakers in the past 18 months have cut the top rate on income taxes and excluded Social Security and other retirement income from the state income tax. Those cuts, when fully in effect, will reduce annual revenue by more than $1 billion.The state is sitting on one of its biggest surpluses in history, with about $6.4 billion on hand on Feb. 29. Revenues for the year, however, are lagging 1.45% behind collections for the previous fiscal year.To soften the impact of repealing the tax, the bill also bars corporations holding state tax credits from claiming them against corporate tax liability in years after the rate is cut to zero. Smith said he received information from the Department of Revenue that there are $600 million to $700 million in outstanding tax credits that could be claimed by corporations.“It just means no new tax credits will be given out and they will not renew the existing tax credits,” Smith said.The fiscal note for the bill, however, reports that tax credit redemptions applied to corporate income taxes totaled $89.7 million in the most recent fiscal year and that redemptions would shift to other taxes if the corporate tax is repealed.“Many of the state tax credits are allowed to be sold, transferred and assigned and it is assumed corporations would continue that practice,” the fiscal note states.The corporate tax rate isn’t a priority for businesses, said Rep. Kemp Strickler, a Democrat from Lee’s Summit. Corporations want well-educated workers and access to materials and services, Strickler said.“Is this a good return on investment?” Strickler asked. “Is that really helping or is this just a giveaway?”This story was originally published in The Missouri Independent, part of the State’s Newsroom.

Business

Chicago Bears pitch $3.2B stadium plan, Pritzker skeptical

The Chicago Bears laid out a $3.2 billion plan for a new domed stadium on Chicago’s lakefront this week, painting pictures of future Super Bowls and other major public events while pinning their hopes on yet-to-be-had conversations with the governor and lawmakers.The Bears — accompanied by Chicago Mayor Brandon Johnson at a Wednesday news conference — proposed a public-private partnership through which the Bears lease the stadium from the Chicago Park District. While the team would put up over $2 billion of the $3.2 billion needed to build the stadium, it’s also seeking $1.5 billion in infrastructure support over several years to realize its vision for a multi-use public park space on Chicago’s lakefront Museum Campus.Chicago Bears president and CEO Kevin Warren said the $2 billion committed by the Bears would be the largest private investment in Chicago history. He also said a new stadium can provide thousands of temporary and long-term jobs for Chicagoans. Warren joined the Bears in early 2023 after previously brokering a deal to bring the Minnesota Vikings a new stadium with a public-private partnership in Minneapolis.“Look around Chicago, I know the mayor is doing all that he can with his leadership to lean in to get economic development going,” Warren said. “We want to be that catalyst.”Despite that major commitment, Bears executives sought to fill an estimated $900 million “gap” through state funding via a bond from the Illinois Sports Facilities Authority, a state agency created in the 1980s to finance new sports stadiums. The team also proposed using the city’s existing hotel tax and restructuring ISFA’s current debt over a 40-year period.While the proposal represents the largest private commitment of any of the recent pushes by professional sports teams for a new stadium yet, it was quickly met with skepticism by Illinois Gov. J.B. Pritzker, who was at a concurrent news conference at Loyola University Chicago.“I’m highly skeptical of the proposal that’s been made and I believe strongly that this is not a high priority for legislators, and certainly not for me when I compare it to all the other things,” Pritzker said.

Dilpreet Raju

/

Capitol News IllinoisChicago Mayor Brandon Johnson and Chicago Bears Chairman George McCaskey pose together after announcing the Bears are seeking to build a new stadium. Johnson said he supports the plan as Illinois Gov. J.B. Pritzker and others raised concern over the use of public dollars.

The governor downplayed the competing news conferences. He’d scheduled his in advance to highlight health insurance reforms that recently cleared the House with his support. The Bears’ announcement was scheduled within the past two days.Part of the proposal includes developing about 15 acres of recreational park space for public use and more stadium vendor businesses owned by women and people of color. Johnson hailed the project for upholding his “criteria for any new development project.”“We require real private investment, real public use and real economic participation for the entire city,” he said.He noted no new taxes would be imposed on Chicago residents and the city can expect “increased tax revenue from this investment, expanded public recreation, stronger economic growth for the entire city of Chicago for generations to come.”Team leaders claimed in their presentation that the stadium would create over 40,000 construction jobs and over 4,000 permanent jobs.The Bears’ presentation noted the organization was seeking about $1.5 billion in three phases of infrastructure investment that could come “at the state level, at the potentially federal level, potentially at the city level,” according to Warren, who gave no specifics.Karen Murphy, the team’s executive vice president of stadium development and chief operating officer, said that includes $325 million in transportation, roadway and utility improvements needed to open the stadium.The remaining funding – at least $1.1 billion – would come over at least five years. That could include $510 million in a second phase of construction for parking upgrades and building surrounding parks and ballfields, followed by $665 million for further attractions and transportation improvements in a third phase. Bears representatives said those estimates are subject to change.Pritzker mentioned “higher priorities for the state” than building a football stadium, including his $4.4 million proposed investment in birth equity centers to create a statewide plan and distribute building grants. And he noted Missouri voters rejected a stadium funding plan for the reigning Super Bowl champion Kansas City Chiefs and for the Kansas City Royals baseball team.“The problem is that the offer that they’ve made just isn’t one that I think the taxpayers are interested in getting engaged in,” Pritzker said of the proposal, later adding, “We’ve seen this fail over and over across the United States.”

Dilpreet Raju

/

Capitol News IllinoisKevin Warren, president and CEO of the Chicago Bears, waits to walk on stage at the Bears’ stadium announcement.

House Speaker Emanuel “Chris” Welch, D-Hillside, who attended the governor’s news conference at Loyola, said he gave Warren a blunt assessment when they recently met privately.“If we were to put this issue on the board for a vote right now, it would fail and it would fail miserably. There is no environment for something like this today,” he said.Senate President Don Harmon, D-Oak Park, also expressed skepticism in a statement.“At first glance, more than $2 billion in private funding is better than zero and a more credible opening offer,” he said. “But there’s an obvious, substantial gap remaining, and I echo the governor’s skepticism.”As for the bonding authority sought by the Bears, Pritzker noted three pro sports teams are seeking money through the ISFA for a new stadium – the Bears, the Chicago White Sox baseball team and the Chicago Red Stars women’s soccer team.“And this is one team that is offering to take all of the tax revenue for their stadium and there apparently is nothing left over for the other two teams,” Pritzker said.While Pritzker had not been briefed on the proposal prior to Wednesday’s news conference, Warren said team representatives “look forward to having some detailed conversations with the state here in the near future.”“Today was the first day that we have been able to publicly roll out our plan,” he said. “It’s very difficult for someone to say they’re against this and we just presented it, so we look forward to having more conversations with individuals in Springfield.”When pressed by media at the Loyola event as to whether there was a “path” for him to support a subsidy plan, Pritzker responded “sure,” but with a caveat.“This has got to be a lot better for taxpayers than what they put forward,” he added. “That’s all I’m saying.”Capitol News Illinois is a nonprofit, nonpartisan news service covering state government. It is distributed to hundreds of newspapers, radio and TV stations statewide. It is funded primarily by the Illinois Press Foundation and the Robert R. McCormick Foundation, along with major contributions from the Illinois Broadcasters Foundation and Southern Illinois Editorial Association.

Business

Boeing buys GKN’s St. Louis plant that makes fighter jet parts

Aerospace company Boeing announced Friday it reached a deal to take over the operations of GKN Aerospace St. Louis, which manufactures parts for Boeing’s F/A-18 and F-15 programs.The agreement among Boeing, GKN and its parent company, Melrose Industries, immediately transitions the latter’s local operations to Boeing. It also includes Boeing hiring the roughly 550-person GKN workforce based in St. Louis.“This is a win-win-win for those employees, Boeing, and the broader St. Louis community,” said Steve Parker, senior vice president and CEO of Boeing Defense, Space and Security, in a statement. “This agreement allows us to not only deliver for our customers, but also gives the highly skilled GKN workforce the opportunity to bring their immense talents to bear in support of the warfighter and the St. Louis defense and aerospace industry.”Local business leaders cheered the move, saying it preserves union jobs and helps the region’s advanced manufacturing sector.“This is a great win for Boeing as well as GKN St. Louis and their 550 employees,” said Greater St. Louis CEO Jason Hall in a statement. “This announcement continues our economic momentum as we look forward to Boeing’s $1.8 billion expansion at the airport.”

Business

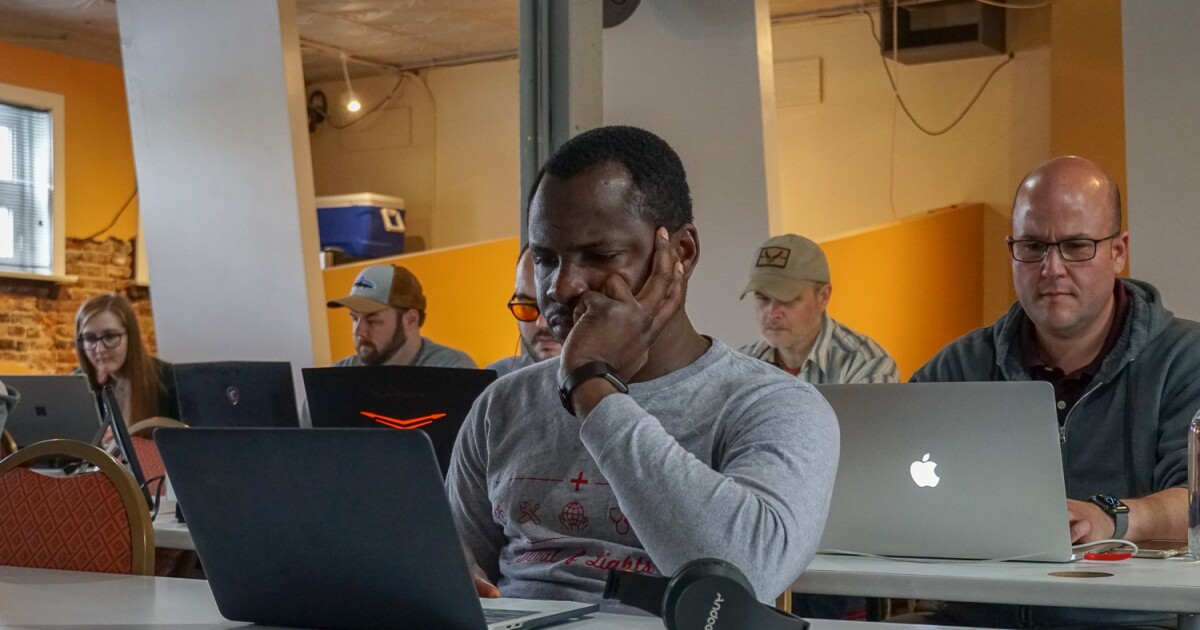

Immigrants in St. Louis are making economic contributions

Although the St. Louis region’s population growth has leveled off over the past decade, there has been a modest increase in the area’s immigrant population. Demographers say this increase is a small but helpful contribution to the economic vibrancy of the region.Immigrants living in the metropolitan area make up 4.8% of the total population. According to a recent analysis by the American Immigration Council, immigrant households in the area earned $5.9 billion in total income, paid $1.6 billion in taxes and held $4.3 billion in spending power.Immigrant families play a vital role in the region’s economic success, said Ness Sandoval, professor of demography and sociology at St. Louis University.“Even though our immigrant population is relatively small — compared to Chicago, Miami or New York — the region is still benefiting from the economic power of this group,” he said. “Imagine what that economic power would be like if the immigrant population was three times as large.”New U.S. Census Bureau data shows that the region dropped from being the 21st largest metropolitan area to the 23rd, in the year ending July 1, 2023. Both the Charlotte and Orlando metropolitan areas surpassed St. Louis. Last year, the city lost about 3,250 residents. Also, St. Louis County lost over 3,730 people.Though there is a population loss, many immigrants are finding their way to the area. Today, over 130,000 immigrants call the region home.Sandoval said the region’s immigrant population needs to be over 10% to be consistent with its peers among the top 20 metropolitan regions.“Imagine the types of businesses that would be out there generating jobs contributing back to the economy, businesses that would be supporting nonprofits,” he said. “That’s not here right now, because we don’t have those immigrant businesses, but the ones that are here, we can already see that economic impact.”Nigerian entrepreneur Ola Ayeni moved from Chicago to St. Louis over a decade ago to open Claim Academy, a software engineering and cybersecurity training school. Arch Grants awarded him $50,000 in 2013 to start the company in St. Louis.“St. Louis has been positive for me because I remember when I [first] moved here, I got a lot of support,” Ayeni said.Ayeni was immediately connected to the International Institute and the St. Louis Mosaic Project, as well as other organizations in the area that help immigrants establish themselves in the region.He credits his success to Arch Grants. Today, the academy employs over 20 people, which include immigrants and native born citizens. Ayeni said the company’s finances are consistently in the black and it brings in millions of dollars a year.Although many immigrants own profitable businesses in the city, Sandoval said he is seeing more immigrants open businesses in municipalities along the Interstate 270 corridor.“We are in competition. Many, many cities and regions across the United States want immigrants to move to their region for the reason of the economic activity that they bring to the region,” he said. “Immigrants are more likely to start small businesses compared to American born citizens, and so this is exciting for the business community to see new businesses created.”Ayeni is also contributing to the region’s economy. Besides the software engineering school, he owns a facial company in Chesterfield and is a real estate investor.St. Louis city and county leaders want to increase the population to grow the economy. Although the immigrants’ economic contributions are a small fraction of the region’s total economy, it is a big fraction, compared to its size of population, Sandoval said.To keep attracting immigrants, he said St. Louis has to put forth more efforts that will continue to increase immigrants’ quality of life.“Immigrants who are saying, ‘I don’t want to live in Houston, I want to find another city, I want to find my American dream,’” Sandoval said. “And so that’s where these institutions come into play, because they can now start to advocate and start to promote what the American dream looks like in the St. Louis metropolitan region.”

-

Entertainment1 year ago

Entertainment1 year agoSt.Louis Man Sounds Just Like Whitley Hewsten, Plans on Performing At The Shayfitz Arena.

-

Business1 year ago

Business1 year agoWe Live Here Auténtico! | The Hispanic Chamber | Community and Connection Central

-

Board Bills1 year ago

2022-2023 Board Bill 189 — Public Works and Improvement Program at the Airport

-

Local News1 year ago

Local News1 year agoVIDEO: St. Louis Visitor Has Meltdown on TikTok Over Gunshots

-

News1 year ago

News1 year agoTed Lasso-inspired pop-up bar now open in St. Louis

-

Board Bills1 year ago

Board Bills1 year ago2022-2023 Board Bill 165 — Jefferson Arms Community Improvement District

-

Board Bills1 year ago

2022-2023 Board Bill 183 — Amending Ordinance Number 62885 known as the Capital Improvements Sales Tax

-

Board Bills1 year ago

2022-2023 Board Bill 180 — Right to Counsel for Tenants Facing Eviction