Politics

Missouri’s senior property tax freeze has unanswered questions

[ad_1]

Last year, the Missouri General Assembly scrambled to act on an issue popular with voters who turn out in large numbers: property tax cuts for seniors in the form of a tax freeze.Lawmakers passed a vague directive letting counties freeze property tax bills for seniors, without defining what “senior” meant, who was going to tell the counties how to define that group or how to pay for the change.Now, feeling pressure from constituents, county expenses are piling up. And with the Statehouse functionally useless as senators eye upcoming elections, clear directions aren’t coming anytime soon.“We have no idea what to expect,” said St. Charles County Commissioner Mike Elam. “We’re going down a road blindly, and we’re trying to make the best-educated guesses that we can.”The biggest Missouri counties with the most dollars to spare are spearheading the change. But with more questions than answers, small counties are waiting to learn from the larger population centers.In line with national trends, Missouri’s population is skewing older. Estimates from the U.S. Census Bureau found that by 2030, more than 25% of Missouri’s population will be over 60. Senior citizens in Missouri are expected to increase 87% from 2000 to 2030.Data compiled by the Missouri Census Data Center found that 7% of senior households in Missouri fell into the “cost-burdened” category from 2012 to 2016, meaning they spent 30% or more of their gross income on housing.How much progress have counties made?All of Missouri’s largest counties have passed ordinances that will eventually freeze real property tax bills for Missourians over 62.Without clear direction from lawmakers in Jefferson City, some versions look different than others. Counties will ask residents to apply again on a yearly basis, but a few details on that application process will be streamlined.Jackson County is accepting applications for the program. Officials included a home value cap of $550,000, so residents with home values over that figure won’t be eligible for the freeze. Taxes will freeze at the 2024 rate, with the first credits to be seen by residents in 2025. In Clay County, applications for the freeze will open in 2025.St. Louis city and St. Louis County followed a similar model and added home value caps of $500,000 and $550,000, respectively. St. Louis County stated on its website that without additional funding to handle the lift of putting the freeze in place, the program won’t be available this year.But under revisions to the law, which have yet to be finally passed in the General Assembly, adding home value caps would be prohibited.A lawsuit recently filed against St. Louis County cited the delay in getting the program up and running. The director of the county revenue department asked the County Council for $1.8 million to hire full-time staff and to pay for equipment and software purchases.St. Charles County was among the first to pass the freeze and estimates that about 38,000 households would qualify for the freeze. They’re doing their best to take a slow and steady approach, Elam said. Between the 2nd and 3rd congressional districts, about 32% of households will qualify, based on data from the Social Security Administration, he said.“We don’t know how many of them are actually going to apply,” Elam said. “This program was started with very good intentions by state legislators. Practically speaking, it’s always different than it is on paper.”Elam has no estimate for the cost of imposing the freeze. It’s unlikely that St. Charles County will follow St. Louis County’s lead by hiring full-time staff, though. Temporary additions to the collector’s and recorder’s offices seem like a better fit, he said.Platte County plans to open applications for the program in September. It intentionally left home value caps off of their ordinance.“It’s not in state statute,” said Commissioner Dagmar Wood, who is running for Platte County assessor. “We feel like we’re just opening up the county for a lawsuit. We’re going to mirror exactly whatever ends up coming out of Jefferson City.”Wood estimates spending around $200,000 to put the program in place. The county has already hired a full-time staffer to help with the additional workload, she said, and it plans to spend from $50,000 to $100,000 sending out mailers to let residents know about the program.That’s something St. Charles County is holding off on for now, Elam said. With so many questions left to answer, they’ll wait to incur large one-time costs until the provision is more clear. But they are thinking about how to get the word out to Missourians over 62 who may not be as digitally savvy.“Unfortunately, the ones who really need this are probably the ones who are not paying as much attention and don’t understand the process,” Elam said.How do schools and libraries feel?Some counties appear hesitant to freeze property taxes for one group out of fear that would limit tax revenue for taxing districts that use property tax revenue, like school districts, libraries or fire departments.Officials in Boone County were assessing the best way to approach the freeze. Voters gave their approval after it was placed on the April 2 ballot.Columbia Public Schools estimated a freeze could cost anywhere from 10% to 20% of district revenue, the Columbia Missourian reported. The cost could range anywhere from $3 million to $6 million.Harrisburg School District Superintendent Steve Combs said nearly one-third of the homes in his Boone County district are owned by residents who would be eligible for the freeze. The district could lose nearly $800,000 in the future.Boone County Commissioner Kip Kendrick told the Missourian that as the county looked for examples from other states that made similar moves, many local school districts typically went on to ask voters to raise tax levies following the eventual revenue decline. He said that officials eventually may schedule the program for renewal to give them more flexibility to add tweaks in the future.It’s something Wood is less worried about in Platte County, where the population is growing.“Our assessment values have gone up, overall valuation on properties has gone up,” Wood said. “I don’t see how this is a negative to taxing districts, except maybe they’re not increasing as fast as they would like.”Lawmakers expect more clarification next yearEven though members of the General Assembly knew they were heading into the 2024 legislative session under pressure to revise the law, lawmakers expect more revisions in coming years.“I would recommend that we pass this and then come back with a fervor next year and fix whatever needs fixing,” Rep. Darin Chappell, a Rogersville Republican, said.“And for those of us who are freshmen, let this be a lesson we’ll learn that maybe we ought to pay more attention before we actually pass bills that are improperly written in the first place,” Chappell said.The revisions would bar homeowners from buying lower-valued property, locking in a lower tax rate and then making improvements to that property under the lower-valued rate. It would also require that anyone 62 or older who is behind on their taxes become current before they are eligible for the freeze.In the House committee, lawmakers suggested requiring property owners to apply annually, which many counties have already included in their statute. Ultimately, they bypassed the change amid fears that the bill may get stalled in the stalemated Senate.Elam said smaller counties are watching as more-resourced ones parse through the details. He said the state association of collectors and Missouri Association of Counties are working together to streamline the process, hopefully eliminating some of the administrative burden down the line.Advocacy group MO Tax Relief Now says it is working with at least 40 counties to put a freeze in place. They estimate that the legislation could save Missourians upward of$500 millionif put in place statewide.The revision bill is SB 756, sponsored by Parkville Republican Sen. Tony Luetkemeyer. This story was originally published by The Kansas City Beacon, an online news outlet focused on local, in-depth journalism in the public interest.

[ad_2]

Source link

Politics

Poll: Support for Missouri abortion rights amendment growing

[ad_1]

A proposed constitutional amendment legalizing abortion in Missouri received support from more than half of respondents in a new poll from St. Louis University and YouGov.That’s a boost from a poll earlier this year, which could mean what’s known as Amendment 3 is in a solid position to pass in November.SLU/YouGov’s poll of 900 likely Missouri voters from Aug. 8-16 found that 52% of respondents would vote for Amendment 3, which would place constitutional protections for abortion up to fetal viability. Thirty-four percent would vote against the measure, while 14% aren’t sure.By comparison, the SLU/YouGov poll from February found that 44% of voters would back the abortion legalization amendment.St. Louis University political science professor Steven Rogers said 32% of Republicans and 53% of independents would vote for the amendment. That’s in addition to nearly 80% of Democratic respondents who would approve the measure. In the previous poll, 24% of Republicans supported the amendment.Rogers noted that neither Amendment 3 nor a separate ballot item raising the state’s minimum wage is helping Democratic candidates. GOP contenders for U.S. Senate, governor, lieutenant governor, treasurer and secretary of state all hold comfortable leads.“We are seeing this kind of crossover voting, a little bit, where there are voters who are basically saying, ‘I am going to the polls and I’m going to support a Republican candidate, but I’m also going to go to the polls and then I’m also going to try to expand abortion access and then raise the minimum wage,’” Rogers said.Republican gubernatorial nominee Mike Kehoe has a 51%-41% lead over Democrat Crystal Quade. And U.S. Sen. Josh Hawley is leading Democrat Lucas Kunce by 53% to 42%. Some GOP candidates for attorney general, secretary of state and treasurer have even larger leads over their Democratic rivals.

Brian Munoz

/

St. Louis Public RadioHundreds of demonstrators pack into a parking lot at Planned Parenthood of St. Louis and Southwest Missouri on June 24, 2022, during a demonstration following the Supreme Court’s reversal of a case that guaranteed the constitutional right to an abortion.

One of the biggest challenges for foes of Amendment 3 could be financial.Typically, Missouri ballot initiatives with well-funded and well-organized campaigns have a better chance of passing — especially if the opposition is underfunded and disorganized. Since the end of July, the campaign committee formed to pass Amendment 3 received more than $3 million in donations of $5,000 or more.That money could be used for television advertisements to improve the proposal’s standing further, Rogers said, as well as point out that Missouri’s current abortion ban doesn’t allow the procedure in the case of rape or incest.“Meanwhile, the anti side won’t have those resources to kind of try to make that counter argument as strongly, and they don’t have public opinion as strongly on their side,” Rogers said.There is precedent of a well-funded initiative almost failing due to opposition from socially conservative voters.In 2006, a measure providing constitutional protections for embryonic stem cell research nearly failed — even though a campaign committee aimed at passing it had a commanding financial advantage.Former state Sen. Bob Onder was part of the opposition campaign to that measure. He said earlier this month it is possible to create a similar dynamic in 2024 against Amendment 3, if social conservatives who oppose abortion rights can band together.“This is not about reproductive rights or care for miscarriages or IVF or anything else,” said Onder, the GOP nominee for Missouri’s 3rd Congressional District seat. “Missourians will learn that out-of-state special interests and dark money from out of state is lying to them and they will reject this amendment.”Quade said earlier this month that Missourians of all political ideologies are ready to roll back the state’s abortion ban.“Regardless of political party, we hear from folks who are tired of politicians being in their doctor’s offices,” Quade said. “They want politicians to mind their own business. So this is going to excite folks all across the political spectrum.”

[ad_2]

Source link

Politics

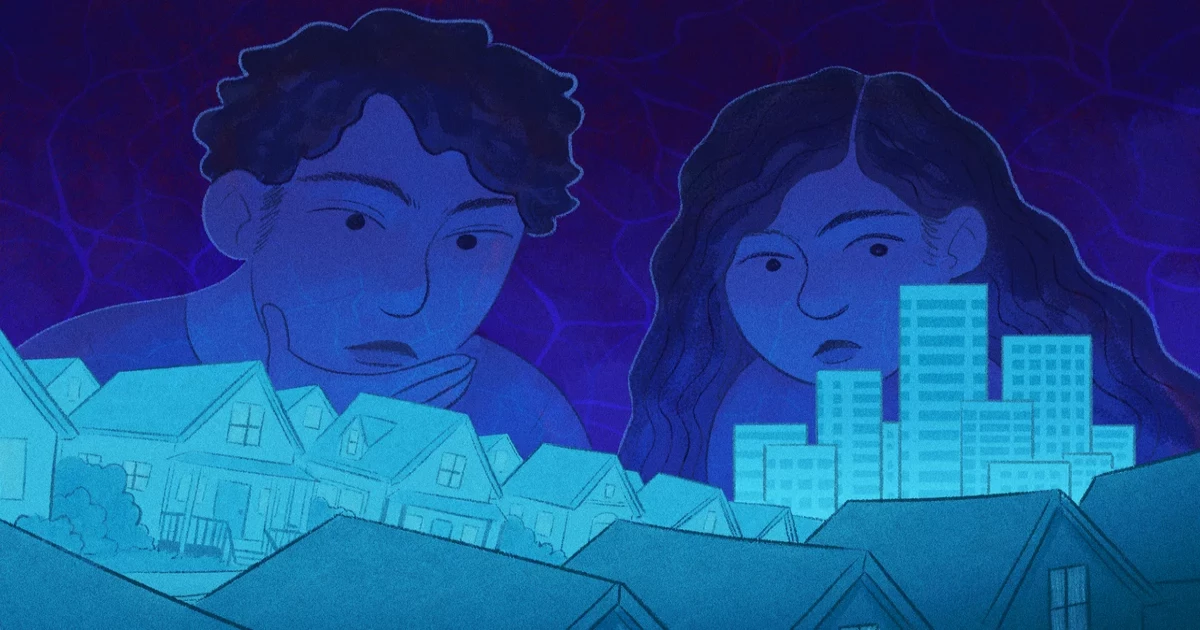

Democrat Mark Osmack makes his case for Missouri treasurer

[ad_1]

Mark Osmack has been out of the electoral fray for awhile, but he never completely abandoned his passion for Missouri politics.Osmack, a Valley Park native and U.S. Army veteran, previously ran for Missouri’s 2nd Congressional District seat and for state Senate. Now he’s the Democratic nominee for state treasurer after receiving a phone call from Missouri Democratic Party Chairman Russ Carnahan asking him to run.“There’s a lot of decision making and processing and evaluation that goes into it, which is something I am very passionate and interested in,” Osmack said this week on an episode of Politically Speaking.Osmack is squaring off against state Treasurer Vivek Malek, who was able to easily win a crowded GOP primary against several veteran lawmakers including House Budget Chairman Cody Smith and state Sen. Andrew Koenig.While Malek was able to attract big donations to his political action committee and pour his own money into the campaign, Osmack isn’t worried that he won’t be able to compete in November. Since Malek was appointed to his post, Osmack contends he hasn’t proven that he’s a formidable opponent in a general election.“His actions and his decision making so far in his roughly two year tenure in that office have been questionable,” Osmack said.Among other things, Osmack was critical of Malek for placing unclaimed property notices on video gaming machines which are usually found in gas stations or convenience stores. The legality of the machines has been questioned for some time.As Malek explained on his own episode of Politically Speaking, he wanted to make sure the unclaimed property program was as widely advertised as possible. But he acknowledged it was a mistake to put the decals close to the machines and ultimately decided to remove them.Osmack said: “This doesn’t even pass the common sense sniff test of, ‘Hey, should I put state stickers claiming you might have a billion dollars on a gambling machine that is not registered with the state of Missouri?’ If we’re gonna give kudos for him acknowledging the wrong thing, it never should have been done in the first place.”Osmack’s platform includes supporting programs providing school meals using Missouri agriculture products and making child care more accessible for the working class.He said the fact that Missouri has such a large surplus shows that it’s possible to create programs to make child care within reach for parents.“It is quite audacious for [Republicans] to brag about $8 billion, with a B, dollars in state surplus, while we offer next to no social services to include pre-K, daycare, or child care,” Osmack said.Here’s are some other topics Osmack discussed on the show:How he would handle managing the state’s pension systems and approving low-income housing tax credits. The state treasurer’s office is on boards overseeing both of those programs.Malek’s decision to cut off investments from Chinese companies. Osmack said that Missouri needs to be cautious about abandoning China as a business partner, especially since they’re a major consumer of the state’s agriculture products. “There’s a way to make this work where we are not supporting communist nations to the detriment of the United States or our allies, while also maintaining strong economic ties that benefit Missouri farmers,” he said.What it was like to witness the skirmish at the Missouri State Fair between U.S. Sen. Josh Hawley and Democratic challenger Lucas Kunce.Whether Kunce can get the support of influential groups like the Democratic Senatorial Campaign Committee, which often channels money and staff to states with competitive Senate elections.

[ad_2]

Source link

Politics

As Illinois receives praise for its cannabis equity efforts, stakeholders work on system’s flaws

[ad_1]

Medical marijuana patients can now purchase cannabis grown by small businesses as part of their allotment, Illinois’ top cannabis regulator said, but smaller, newly licensed cannabis growers are still seeking greater access to the state’s medical marijuana customers.Illinois legalized medicinal marijuana beginning in 2014, then legalized it for recreational use in 2020. While the 2020 law legalized cannabis use for any adult age 21 or older, it did not expand licensing for medical dispensaries.Patients can purchase marijuana as part of the medical cannabis program at dual-purpose dispensaries, which are licensed to serve both medical and recreational customers. But dual-purpose dispensaries are greatly outnumbered by dispensaries only licensed to sell recreationally, and there are no medical-only dispensaries in the state.As another part of the adult-use legalization law, lawmakers created a “craft grow” license category that was designed to give more opportunities to Illinoisans hoping to legally grow and sell marijuana. The smaller-scale grow operations were part of the 2020 law’s efforts to diversify the cannabis industry in Illinois.Prior to that, all cultivation centers in Illinois were large-scale operations dominated by large multi-state operators. The existing cultivators, mostly in operation since 2014, were allowed to grow recreational cannabis beginning in 2019.Until recently, dual-purpose dispensaries have been unsure as to whether craft-grown products, made by social equity licensees — those who have lived in a disproportionately impacted area or have been historically impacted by the war on drugs — can be sold medicinally as part of a patient’s medical allotment.Erin Johnson, the state’s cannabis regulation oversight officer, told Capitol News Illinois last month that her office has “been telling dispensaries, as they have been asking us” they can now sell craft-grown products to medical patients.“There was just a track and trace issue on our end, but never anything statutorily,” she said.

Dilpreet Raju

/

Capitol News IllinoisThe graphic shows how cannabis grown in Illinois gets from cultivation centers to customers.

No notice has been posted, but Johnson’s verbal guidance comes almost two years after the first craft grow business went online in Illinois.It allows roughly 150,000 medical patients, who dispensary owners say are the most consistent purchasers of marijuana, to buy products made by social equity businesses without paying recreational taxes. However — even as more dispensaries open — the number available to medical patients has not increased since 2018, something the Cannabis Regulation Oversight Office “desperately” wants to see changed. Johnson said Illinois is a limited license state, meaning “there are caps on everything” to help control the relatively new market.Berwyn Thompkins, who operates two cannabis businesses, said the rules limited options for patients and small businesses.“It’s about access,” Thompkins said. “Why wouldn’t we want all the patients — which the (adult-use) program was initially built around — why wouldn’t we want them to have access? They should have access to any dispensary.”Customers with a medical marijuana card pay a 1% tax on all marijuana products, whereas recreational customers pay retail taxes between roughly 20 and 40% on a given cannabis product, when accounting for local taxes.While Illinois has received praise for its equity-focused cannabis law, including through an independent study that showed more people of color own cannabis licenses than in any other state, some industry operators say they’ve experienced many unnecessary hurdles getting their businesses up and running.The state, in fact, announced last month that it had opened its 100th social equity dispensary.But Steve Olson, purchasing manager at a pair of dispensaries (including one dual-purpose dispensary) near Rockford, said small specialty license holders have been left in the lurch since the first craft grower opened in October 2022.“You would think that this would be something they’re (the government) trying to help out these social equity companies with, but they’re putting handcuffs on them in so many different spots,” he said. “One of them being this medical thing.”Olson said he contacted state agencies, including the Department of Financial and Professional Regulation, months ago about whether craft products can be sold to medical patients at their retail tax rate, but only heard one response: “They all say it was an oversight.”This potentially hurt social equity companies because they sell wholesale to dispensaries and may have been missing out on a consistent customer base through those medical dispensaries.Olson said the state’s attempts to provide licensees with a path to a successful business over the years, such as with corrective lotteries that granted more social equity licenses, have come up short.“It’s like they almost set up the social equity thing to fail so the big guys could come in and swoop up all these licenses,” Olson said. “I hate to feel like that but, if you look at it, it’s pretty black and white.”Olson said craft companies benefit from any type of retail sale.“If we sell it to medical patients or not, it’s a matter of, ‘Are we collecting the proper taxes?’ That’s all it is,” he said.State revenue from cannabis taxes, licensing costs and other fees goes into the Cannabis Regulation Fund, which is used to fund a host of programs, including cannabis offense expungement, the general revenue fund, and the R3 campaign aiming to uplift disinvested communities.For fiscal year 2024, nearly $256 million was paid out from Cannabis Regulation Fund for related initiatives, which includes almost $89 million transferred to the state’s general revenue fund and more than $20 million distributed to local governments, according to the Illinois Department of Revenue.Medical access still limitedThe state’s 55 medical dispensaries that predate the 2020 legalization law, mostly owned by publicly traded multistate operators that had been operating in Illinois since 2014 under the state’s medical marijuana program, were automatically granted a right to licenses to sell recreationally in January 2020. That gave them a dual-purpose license that no new entrants into the market can receive under current law.Since expanding their clientele in 2020, Illinois dispensaries have sold more than $6 billion worth of cannabis products through recreational transactions alone.Nearly two-thirds of dispensaries licensed to sell to medical patients are in the northeast counties of Cook, DuPage, Kane, Lake and Will. Dual-purpose dispensaries only represent about 20 percent of the state’s dispensaries.While the state began offering recreational dispensary licenses since the adult-use legalization law passed, it has not granted a new medical dispensary license since 2018. That has allowed the established players to continue to corner the market on the state’s nearly 150,000 medical marijuana patients.But social equity licensees and advocates say there are more ways to level the playing field, including expanding access to medical sales.Johnson, who became the state’s top cannabis regulator in late 2022, expressed hope for movement during the fall veto session on House Bill 2911, which would expand medical access to all Illinois dispensaries.“We would like every single dispensary in Illinois to be able to serve medical patients,” Johnson said. “It’s something that medical patients have been asking for, for years.”Johnson said the bill would benefit patients and small businesses.“It’s something we desperately want to happen as a state system, because we want to make sure that medical patients are able to easily access what they need,” she said. “We also think it’s good for our social equity dispensaries, as they’re opening, to be able to serve medical patients.”Rep. Bob Morgan, D-Deerfield, who was the first statewide project coordinator for Illinois’ medical cannabis program prior to joining the legislature, wrote in an email to Capitol News Illinois that the state needs to be doing more for its patients.“Illinois is failing the state’s 150,000 medical cannabis patients with debilitating conditions. Too many are still denied the patient protections they deserve, including access to their medicine,” Morgan wrote, adding he would continue to work with stakeholders on further legislation.Capitol News Illinois is a nonprofit, nonpartisan news service covering state government. It is distributed to hundreds of newspapers, radio and TV stations statewide. It is funded primarily by the Illinois Press Foundation and the Robert R. McCormick Foundation, along with major contributions from the Illinois Broadcasters Foundation and Southern Illinois Editorial Association.

[ad_2]

Source link

-

Politics2 years ago

Politics2 years agoPrenzler ‘reconsidered’ campaign donors, accepts vendor funds

-

Board Bills2 years ago

2024-2025 Board Bill 80 — Prohibiting Street Takeovers

-

Board Bills3 years ago

Board Bills3 years ago2022-2023 Board Bill 168 — City’s Capital Fund

-

Business3 years ago

Business3 years agoFields Foods to open new grocery in Pagedale in March

-

Business3 years ago

Business3 years agoWe Live Here Auténtico! | The Hispanic Chamber | Community and Connection Central

-

Entertainment2 years ago

Entertainment2 years agoOK, That New Cardinals/Nelly City Connect Collab Is Kind of Great

-

Entertainment3 years ago

Entertainment3 years agoSt.Louis Man Sounds Just Like Whitley Hewsten, Plans on Performing At The Shayfitz Arena.

-

Local News3 years ago

Local News3 years agoFox 2 Reporter Tim Ezell Reveals He Has Parkinson’s Disease | St. Louis Metro News | St. Louis